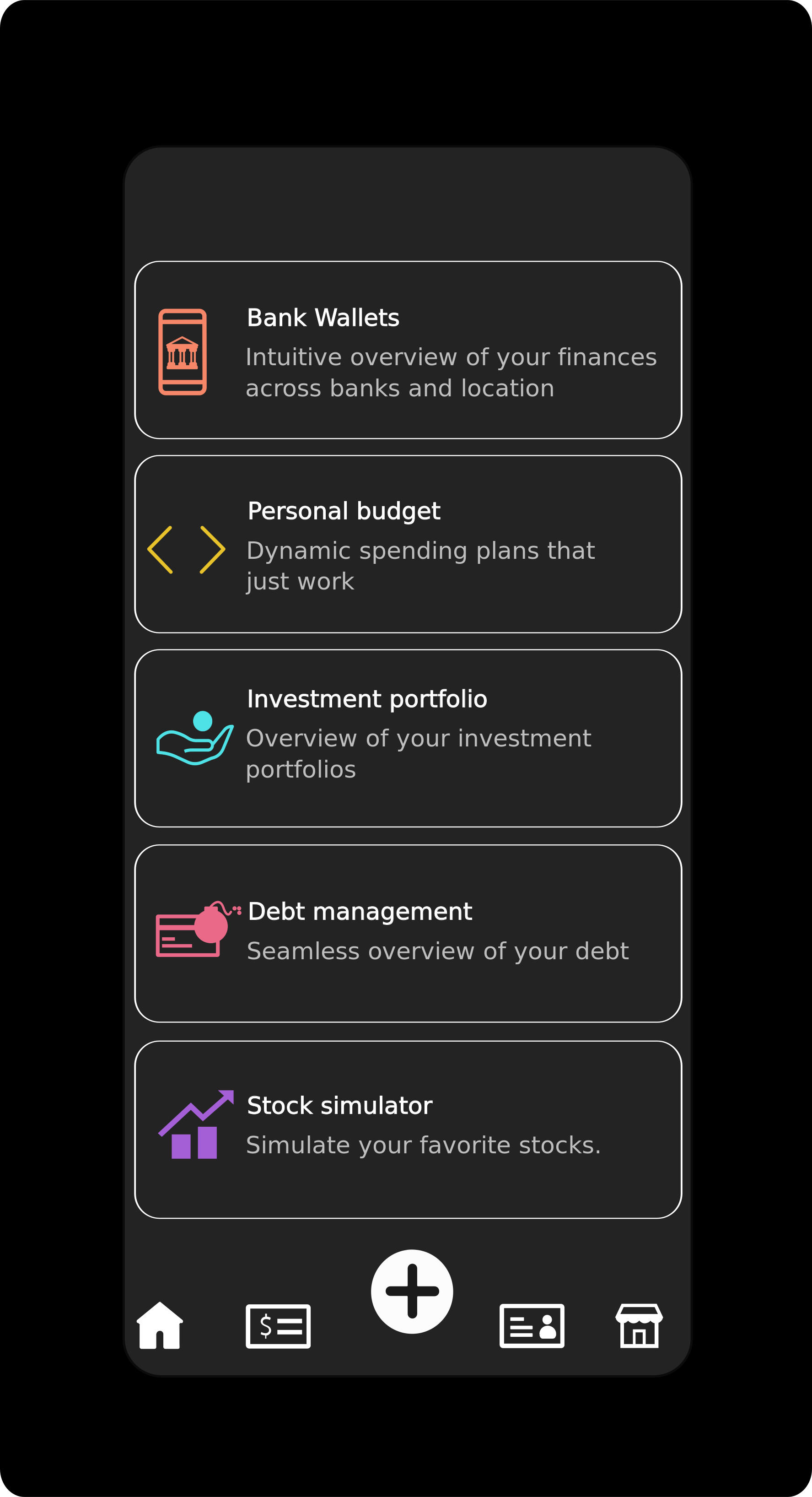

Paiblock extends In-app banking coverage to Canadian banks

Puut Wallet changes Brand Name and Corporate Identity to Paiblock

BIOMETRIC AUTHENTICATION: THE NEXT LEVEL OF MOBILE PAYMENT SECURITY

BIOMETRIC AUTHENTICATION: THE NEXT LEVEL OF MOBILE PAYMENT SECURITY

Security in the mobile industry has always been a primary issue ever since smartphones and other mobile gadgets became the most preferred medium to conduct personal and work-related activities. Plenty of our sensitive information is stored on our smartphones alone. Who among us doesn’t use an app to access our bank accounts, for instance? How many passwords and e-mails do your browser’s cache, store or remember?

Without a doubt, these facts assert the need for better security in order to lessen instances of privacy invasion, hacking and identity theft, to cite but some of the crimes that are becoming prevalent nowadays. That being said, experts are suggesting that the use of biometric technology could very well be the best solution to address these issues.

What are Biometrics and Authentication?

When people encounter the word biometric authentication, the most common mental images they conjure are probably ones that involve a machine scanning your fingerprints or face. While this isn’t entirely far off from how this technology is applied, it barely scratches the surface of its potential and practical benefits.

You’ll probably gain a better inkling of how the technology functions if you learn the individual definitions of both. Biometrics, in general, is a way of measuring and analyzing the fundamental characteristics of a person (i.e. behavior, physical features). It is most often used in tandem with authentication. Behavioral biometrics could also involve a person’s voice or body language, and even pertain to his unique keystroke patterns.

Authentication, of course, is simply the act of confirming the identity and genuineness of something. More often than not, it is an individual that needs verification but it could also be a certain process. Put together, the terms evidently have one common goal: heightened security.

How Biometric Authentication is Utilized for Mobile Payment Security

Payments that involve fingerprint scanning and facial recognition are already being conducted worldwide, and these are only expected to become the norm with the passage of time. In the mobile industry, developers often use apps to perform the authentication.

It could be an app that is tied solely to an online business (like in the case of Alibaba’s Smile to Pay app). It capitalizes on the facial recognition technology at present. While it does make use of smartphones for verification, the technology doesn’t really rely on mobile phones consistently for verification.

There are other ways in which that kind of setup is applied. Presently, the most common way involves fingerprint scanning and voice command that serves as an alternative to inputting one’s username and password or when confirming the use of your credit card.

Blockchain technology is also more than willing to utilize this kind of setup. These kinds of emerging technologies have already gathered enough authority to influence the way payments can be made differently and more securely.

Ultimately, the advent of smartphones that have fingerprint scanning features (through built-in sensors) practically seals the fact that mobile payments are to become the norm in the future.

How Biometric Authentication is Utilized for Mobile Payment Security

The most apparent and best reason for the implementation of biometric authentication is better overall security. Of course, better security only ever translates to better trust, which would create a domino-like effect that would only improve the way business is conducted.

It can also streamline the whole process of paying for practically anything. The simple act of having your face or finger scanned immediately erases a lot of the steps involved in standard identity verification. In short, biometric authentication brings better convenience along with veritable time-saving benefits.

The technology can also deter plenty of fraudulent activities involved in mobile payments before they even occur.

It gives better opportunities for data analytics and makes auditing easier as well.

Why you should choose a Mobile Wallet with Bitcoin Transactions

BIOMETRIC AUTHENTICATION: THE NEXT LEVEL OF MOBILE PAYMENT SECURITY

Security in the mobile industry has always been a primary issue ever since smartphones and other mobile gadgets became the most preferred medium to conduct personal and work-related activities. Plenty of our sensitive information is stored on our smartphones alone. Who among us doesn’t use an app to access our bank accounts, for instance? How many passwords and e-mails do your browser’s cache, store or remember?

Without a doubt, these facts assert the need for better security in order to lessen instances of privacy invasion, hacking and identity theft, to cite but some of the crimes that are becoming prevalent nowadays. That being said, experts are suggesting that the use of biometric technology could very well be the best solution to address these issues.

What are Biometrics and Authentication?

When people encounter the word biometric authentication, the most common mental images they conjure are probably ones that involve a machine scanning your fingerprints or face. While this isn’t entirely far off from how this technology is applied, it barely scratches the surface of its potential and practical benefits.

You’ll probably gain a better inkling of how the technology functions if you learn the individual definitions of both. Biometrics, in general, is a way of measuring and analyzing the fundamental characteristics of a person (i.e. behavior, physical features). It is most often used in tandem with authentication. Behavioral biometrics could also involve a person’s voice or body language, and even pertain to his unique keystroke patterns.

Authentication, of course, is simply the act of confirming the identity and genuineness of something. More often than not, it is an individual that needs verification but it could also be a certain process. Put together, the terms evidently have one common goal: heightened security.

How Biometric Authentication is Utilized for Mobile Payment Security

Payments that involve fingerprint scanning and facial recognition are already being conducted worldwide, and these are only expected to become the norm with the passage of time. In the mobile industry, developers often use apps to perform the authentication.

It could be an app that is tied solely to an online business (like in the case of Alibaba’s Smile to Pay app). It capitalizes on the facial recognition technology at present. While it does make use of smartphones for verification, the technology doesn’t really rely on mobile phones consistently for verification.

There are other ways in which that kind of setup is applied. Presently, the most common way involves fingerprint scanning and voice command that serves as an alternative to inputting one’s username and password or when confirming the use of your credit card.

Blockchain technology is also more than willing to utilize this kind of setup. These kinds of emerging technologies have already gathered enough authority to influence the way payments can be made differently and more securely.

Ultimately, the advent of smartphones that have fingerprint scanning features (through built-in sensors) practically seals the fact that mobile payments are to become the norm in the future.

How Biometric Authentication is Utilized for Mobile Payment Security

The most apparent and best reason for the implementation of biometric authentication is better overall security. Of course, better security only ever translates to better trust, which would create a domino-like effect that would only improve the way business is conducted.

It can also streamline the whole process of paying for practically anything. The simple act of having your face or finger scanned immediately erases a lot of the steps involved in standard identity verification. In short, biometric authentication brings better convenience along with veritable time-saving benefits.

The technology can also deter plenty of fraudulent activities involved in mobile payments before they even occur.

It gives better opportunities for data analytics and makes auditing easier as well.

Why the Mobile Wallet is here to Stay?

BIOMETRIC AUTHENTICATION: THE NEXT LEVEL OF MOBILE PAYMENT SECURITY

Security in the mobile industry has always been a primary issue ever since smartphones and other mobile gadgets became the most preferred medium to conduct personal and work-related activities. Plenty of our sensitive information is stored on our smartphones alone. Who among us doesn’t use an app to access our bank accounts, for instance? How many passwords and e-mails do your browser’s cache, store or remember?

Without a doubt, these facts assert the need for better security in order to lessen instances of privacy invasion, hacking and identity theft, to cite but some of the crimes that are becoming prevalent nowadays. That being said, experts are suggesting that the use of biometric technology could very well be the best solution to address these issues.

What are Biometrics and Authentication?

When people encounter the word biometric authentication, the most common mental images they conjure are probably ones that involve a machine scanning your fingerprints or face. While this isn’t entirely far off from how this technology is applied, it barely scratches the surface of its potential and practical benefits.

You’ll probably gain a better inkling of how the technology functions if you learn the individual definitions of both. Biometrics, in general, is a way of measuring and analyzing the fundamental characteristics of a person (i.e. behavior, physical features). It is most often used in tandem with authentication. Behavioral biometrics could also involve a person’s voice or body language, and even pertain to his unique keystroke patterns.

Authentication, of course, is simply the act of confirming the identity and genuineness of something. More often than not, it is an individual that needs verification but it could also be a certain process. Put together, the terms evidently have one common goal: heightened security.

How Biometric Authentication is Utilized for Mobile Payment Security

Payments that involve fingerprint scanning and facial recognition are already being conducted worldwide, and these are only expected to become the norm with the passage of time. In the mobile industry, developers often use apps to perform the authentication.

It could be an app that is tied solely to an online business (like in the case of Alibaba’s Smile to Pay app). It capitalizes on the facial recognition technology at present. While it does make use of smartphones for verification, the technology doesn’t really rely on mobile phones consistently for verification.

There are other ways in which that kind of setup is applied. Presently, the most common way involves fingerprint scanning and voice command that serves as an alternative to inputting one’s username and password or when confirming the use of your credit card.

Blockchain technology is also more than willing to utilize this kind of setup. These kinds of emerging technologies have already gathered enough authority to influence the way payments can be made differently and more securely.

Ultimately, the advent of smartphones that have fingerprint scanning features (through built-in sensors) practically seals the fact that mobile payments are to become the norm in the future.

How Biometric Authentication is Utilized for Mobile Payment Security

The most apparent and best reason for the implementation of biometric authentication is better overall security. Of course, better security only ever translates to better trust, which would create a domino-like effect that would only improve the way business is conducted.

It can also streamline the whole process of paying for practically anything. The simple act of having your face or finger scanned immediately erases a lot of the steps involved in standard identity verification. In short, biometric authentication brings better convenience along with veritable time-saving benefits.

The technology can also deter plenty of fraudulent activities involved in mobile payments before they even occur.

It gives better opportunities for data analytics and makes auditing easier as well.

Mobile Wallet Systems: The Era of a Cashless Future

BIOMETRIC AUTHENTICATION: THE NEXT LEVEL OF MOBILE PAYMENT SECURITY

Security in the mobile industry has always been a primary issue ever since smartphones and other mobile gadgets became the most preferred medium to conduct personal and work-related activities. Plenty of our sensitive information is stored on our smartphones alone. Who among us doesn’t use an app to access our bank accounts, for instance? How many passwords and e-mails do your browser’s cache, store or remember?

Without a doubt, these facts assert the need for better security in order to lessen instances of privacy invasion, hacking and identity theft, to cite but some of the crimes that are becoming prevalent nowadays. That being said, experts are suggesting that the use of biometric technology could very well be the best solution to address these issues.

What are Biometrics and Authentication?

When people encounter the word biometric authentication, the most common mental images they conjure are probably ones that involve a machine scanning your fingerprints or face. While this isn’t entirely far off from how this technology is applied, it barely scratches the surface of its potential and practical benefits.

You’ll probably gain a better inkling of how the technology functions if you learn the individual definitions of both. Biometrics, in general, is a way of measuring and analyzing the fundamental characteristics of a person (i.e. behavior, physical features). It is most often used in tandem with authentication. Behavioral biometrics could also involve a person’s voice or body language, and even pertain to his unique keystroke patterns.

Authentication, of course, is simply the act of confirming the identity and genuineness of something. More often than not, it is an individual that needs verification but it could also be a certain process. Put together, the terms evidently have one common goal: heightened security.

How Biometric Authentication is Utilized for Mobile Payment Security

Payments that involve fingerprint scanning and facial recognition are already being conducted worldwide, and these are only expected to become the norm with the passage of time. In the mobile industry, developers often use apps to perform the authentication.

It could be an app that is tied solely to an online business (like in the case of Alibaba’s Smile to Pay app). It capitalizes on the facial recognition technology at present. While it does make use of smartphones for verification, the technology doesn’t really rely on mobile phones consistently for verification.

There are other ways in which that kind of setup is applied. Presently, the most common way involves fingerprint scanning and voice command that serves as an alternative to inputting one’s username and password or when confirming the use of your credit card.

Blockchain technology is also more than willing to utilize this kind of setup. These kinds of emerging technologies have already gathered enough authority to influence the way payments can be made differently and more securely.

Ultimately, the advent of smartphones that have fingerprint scanning features (through built-in sensors) practically seals the fact that mobile payments are to become the norm in the future.

How Biometric Authentication is Utilized for Mobile Payment Security

The most apparent and best reason for the implementation of biometric authentication is better overall security. Of course, better security only ever translates to better trust, which would create a domino-like effect that would only improve the way business is conducted.

It can also streamline the whole process of paying for practically anything. The simple act of having your face or finger scanned immediately erases a lot of the steps involved in standard identity verification. In short, biometric authentication brings better convenience along with veritable time-saving benefits.

The technology can also deter plenty of fraudulent activities involved in mobile payments before they even occur.

It gives better opportunities for data analytics and makes auditing easier as well.

Why Loyalty Points Are Becoming Mobile Wallet Currency

BIOMETRIC AUTHENTICATION: THE NEXT LEVEL OF MOBILE PAYMENT SECURITY

Security in the mobile industry has always been a primary issue ever since smartphones and other mobile gadgets became the most preferred medium to conduct personal and work-related activities. Plenty of our sensitive information is stored on our smartphones alone. Who among us doesn’t use an app to access our bank accounts, for instance? How many passwords and e-mails do your browser’s cache, store or remember?

Without a doubt, these facts assert the need for better security in order to lessen instances of privacy invasion, hacking and identity theft, to cite but some of the crimes that are becoming prevalent nowadays. That being said, experts are suggesting that the use of biometric technology could very well be the best solution to address these issues.

What are Biometrics and Authentication?

When people encounter the word biometric authentication, the most common mental images they conjure are probably ones that involve a machine scanning your fingerprints or face. While this isn’t entirely far off from how this technology is applied, it barely scratches the surface of its potential and practical benefits.

You’ll probably gain a better inkling of how the technology functions if you learn the individual definitions of both. Biometrics, in general, is a way of measuring and analyzing the fundamental characteristics of a person (i.e. behavior, physical features). It is most often used in tandem with authentication. Behavioral biometrics could also involve a person’s voice or body language, and even pertain to his unique keystroke patterns.

Authentication, of course, is simply the act of confirming the identity and genuineness of something. More often than not, it is an individual that needs verification but it could also be a certain process. Put together, the terms evidently have one common goal: heightened security.

How Biometric Authentication is Utilized for Mobile Payment Security

Payments that involve fingerprint scanning and facial recognition are already being conducted worldwide, and these are only expected to become the norm with the passage of time. In the mobile industry, developers often use apps to perform the authentication.

It could be an app that is tied solely to an online business (like in the case of Alibaba’s Smile to Pay app). It capitalizes on the facial recognition technology at present. While it does make use of smartphones for verification, the technology doesn’t really rely on mobile phones consistently for verification.

There are other ways in which that kind of setup is applied. Presently, the most common way involves fingerprint scanning and voice command that serves as an alternative to inputting one’s username and password or when confirming the use of your credit card.

Blockchain technology is also more than willing to utilize this kind of setup. These kinds of emerging technologies have already gathered enough authority to influence the way payments can be made differently and more securely.

Ultimately, the advent of smartphones that have fingerprint scanning features (through built-in sensors) practically seals the fact that mobile payments are to become the norm in the future.

How Biometric Authentication is Utilized for Mobile Payment Security

The most apparent and best reason for the implementation of biometric authentication is better overall security. Of course, better security only ever translates to better trust, which would create a domino-like effect that would only improve the way business is conducted.

It can also streamline the whole process of paying for practically anything. The simple act of having your face or finger scanned immediately erases a lot of the steps involved in standard identity verification. In short, biometric authentication brings better convenience along with veritable time-saving benefits.

The technology can also deter plenty of fraudulent activities involved in mobile payments before they even occur.

It gives better opportunities for data analytics and makes auditing easier as well.

A Digital War: Mobile Banking vs Mobile Wallet

BIOMETRIC AUTHENTICATION: THE NEXT LEVEL OF MOBILE PAYMENT SECURITY

Security in the mobile industry has always been a primary issue ever since smartphones and other mobile gadgets became the most preferred medium to conduct personal and work-related activities. Plenty of our sensitive information is stored on our smartphones alone. Who among us doesn’t use an app to access our bank accounts, for instance? How many passwords and e-mails do your browser’s cache, store or remember?

Without a doubt, these facts assert the need for better security in order to lessen instances of privacy invasion, hacking and identity theft, to cite but some of the crimes that are becoming prevalent nowadays. That being said, experts are suggesting that the use of biometric technology could very well be the best solution to address these issues.

What are Biometrics and Authentication?

When people encounter the word biometric authentication, the most common mental images they conjure are probably ones that involve a machine scanning your fingerprints or face. While this isn’t entirely far off from how this technology is applied, it barely scratches the surface of its potential and practical benefits.

You’ll probably gain a better inkling of how the technology functions if you learn the individual definitions of both. Biometrics, in general, is a way of measuring and analyzing the fundamental characteristics of a person (i.e. behavior, physical features). It is most often used in tandem with authentication. Behavioral biometrics could also involve a person’s voice or body language, and even pertain to his unique keystroke patterns.

Authentication, of course, is simply the act of confirming the identity and genuineness of something. More often than not, it is an individual that needs verification but it could also be a certain process. Put together, the terms evidently have one common goal: heightened security.

How Biometric Authentication is Utilized for Mobile Payment Security

Payments that involve fingerprint scanning and facial recognition are already being conducted worldwide, and these are only expected to become the norm with the passage of time. In the mobile industry, developers often use apps to perform the authentication.

It could be an app that is tied solely to an online business (like in the case of Alibaba’s Smile to Pay app). It capitalizes on the facial recognition technology at present. While it does make use of smartphones for verification, the technology doesn’t really rely on mobile phones consistently for verification.

There are other ways in which that kind of setup is applied. Presently, the most common way involves fingerprint scanning and voice command that serves as an alternative to inputting one’s username and password or when confirming the use of your credit card.

Blockchain technology is also more than willing to utilize this kind of setup. These kinds of emerging technologies have already gathered enough authority to influence the way payments can be made differently and more securely.

Ultimately, the advent of smartphones that have fingerprint scanning features (through built-in sensors) practically seals the fact that mobile payments are to become the norm in the future.

How Biometric Authentication is Utilized for Mobile Payment Security

The most apparent and best reason for the implementation of biometric authentication is better overall security. Of course, better security only ever translates to better trust, which would create a domino-like effect that would only improve the way business is conducted.

It can also streamline the whole process of paying for practically anything. The simple act of having your face or finger scanned immediately erases a lot of the steps involved in standard identity verification. In short, biometric authentication brings better convenience along with veritable time-saving benefits.

The technology can also deter plenty of fraudulent activities involved in mobile payments before they even occur.

It gives better opportunities for data analytics and makes auditing easier as well.